Centralized crypto saw trading volume year

Mobile Menu Overlay

As shown in Exhibit 8, institutions that have not launched cryptocurrency offerings cite regulatory concerns and cybersecurity as their main reasons for their hesitance. These are legitimate concerns. Cryptocurrencies have proven vulnerable to security breaches, with even well-known names like Crypto.com experiencing losses of millions of dollars due to security breaches. In addition, many financial services firms lack the expertise needed to develop products or even advise clients about cryptocurrencies and digital assets. Crypto exchanges saw trillion trading year After a torrid 2022 saw the downfall of FTX and Sam Bankman-Fried, 2023 has seen more crypto giants come a cropper.

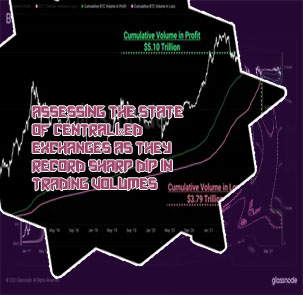

Centralized crypto saw over trillion volume

Spot trading volume across all centralised exchanges rose 34% to over $1.3 trillion, its highest since June 2022, according to a report from crypto data provider CCData. Spot volumes on CEXs plunge to 2019 levels, but there is a silver lining 8/8/2022 – The Treasury Department sanctions notorious crypto “mixer” Tornado Cash (a mixer expedites the process of laundering cryptocurrencies by “mixing” legal crypto assets with illegal to obscure crypto currency origins). Tornado Cash has been in particular use by North Korean hackers, who are said to have laundered $455 million of Ethereum in March. Critics within the crypto industry have pushed back on OFAC’s decision in this case to blacklist code, rather than specific individuals or businesses.

Apply for Fuse Web3 Business Grant Program

Lars0x, a blockchain analyst, revealed that legitimate centralized exchange spot volume fell by 43.8% to $400.5 billion in April. He attributed the majority of the decrease to Binance reintroducing fees on Bitcoin (BTC) pairs. What Happened to FTX? Somensatto also discussed a clear advantage that stablecoins — and all crypto — provide when compared with fiat currency. “The inherent transparency of blockchain technology empowers global regulators, including those in the U.S., to investigate and combat illicit activities efficiently,” he said. “This transparency can also enhance the enforcement of sanctions, allowing participants throughout the crypto ecosystem to screen for and detect activities involving sanctioned entities.”