How much has bitcoin gone up

What is crypto?

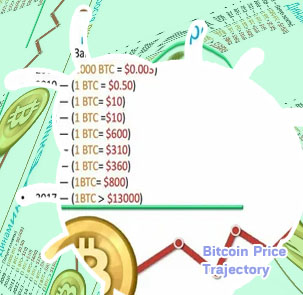

The author of “Bitcoin: A Peer-to-Peer Electronic Cash System” and the developer of the first Bitcoin client, Satoshi Nakamoto, saw the potential of using a decentralized network to create a digital currency immune to government intervention and manipulation. In addition, he was interested in cryptography, which partially explains why this technology was the critical element of the system. Bitcoins initial price Despite their high valuations on paper, a collapse of Bitcoin and other cryptocurrencies is unlikely to rattle the financial system. Banks have mostly stayed on the sidelines. As with any speculative bubble, naive investors who come to the party late are at greatest risk of losses. The government should certainly caution retail investors that, much like in the GameStop saga, they act at their own peril. Securities that enable speculation on Bitcoin prices are already regulated, but there is not much more the government can or ought to do.

How long did it take for bitcoin to rise

All the prices listed on this page are sourced via Coinbase - it is important to check your investments from a single source because different sellers values will vary. For example, today 6 February 2024, the price of Bitcoin on Coinbase is ₹ 35,56,029, with a daily change of 0.37%, while on WazirX, the price is ₹ 37,50,136 and a daily change of -0.37%. Where are bitcoin prices heading now? The world’s first cryptocurrency, Bitcoin (BTC) was conceived in 2008 by the anonymous creator Satoshi Nakamoto before launching in January 2009. Its release would pave the way for a deluge of blockchains and thousands of cryptocurrencies to enter the world. Bitcoin‘s price journey has been a highly eventful one from the start, undergoing its fair share of peaks and valleys.

Bitcoin Passes $20k For The First Time, Leaving 2017's All Time High Price Behind - December 16, 2020

Something that at first seems absurd and pure speculation generates its propagation, along with it the joys and sorrows of speculative decisions on exchange platforms. Would Bitcoin have become so famous if people didn't see it as a means of investment? It has many advantages, but to really make sense it has to be a global system. To achieve this, it has to go through a few years of expansion. One that will allow its users to enjoy its full potential. If You Invested $1,000 in Bitcoin 10 Years Ago, Here's How Much You'd Have Today Dec. 10, 2017: Bitcoin-mania was fully underway by this point, with prices exploding to $13,160. That $100 would today be worth $332.